INVESTMENT APPROACH

Everberg targets high-quality companies undergoing some form of transition. Our objective is to underwrite custom capital solutions for our partners wherein we go beyond boilerplate lender documentation and commonplace investment frameworks. We partner with family-owned businesses, entrepreneurs, and financial sponsors to provide capital for acquisition financing, leveraged buyouts, growth opportunities, and recapitalizations or refinancings.

What We Avoid

Everberg avoids investments in distressed situations, in commodity beholden companies, in situations where liquidity gaps can lead to insolvency, and in business models where the incentives between management and customers are misaligned.

Long-Term Value Creation Goals

Our investment approach is proactive and supportive. Practices aimed at value creation, M&A opportunity discovery and integration, capital markets expertise, six sigma operations assessment, and zero-based budgeting are just a few of the additional resources we provide.

INVESTMENT CRITERIA

Everberg targets sponsored and un-sponsored transactions with LTM EBITDA in the range of $10 to $75 million and invests $10 million to $100 million per transaction (excluding co-investors).

INVESTMENT VERTICALS

Industrials

• Consumable manufactured parts

• Highly engineered components

• Food processing machinery and equipment

• Composite building materials

• HVAC components and equipment supply

• Flexible packaging and co-packaging

Business Services

• Testing and inspection services

• Technology-enabled services

• Aftermarket and value-added distribution

• Logistic and supply chain solutions

• Commercial facility and residential services

• Financial services

Consumer

• Branded consumer packaged goods

• Education

• Veterinarian services, pet daycare, and grooming

• Consumer services

• Food and beverage

• Pest control services

• Beauty, health, and wellness

• Franchise models

Healthcare

• Physical therapy

• Behavioral health

• Continued education, certification, and training

• Home health services

• Health CRM and management software

• Consumable medical equipment and supplies

• Practice Management

TRANSACTION THEMES

Everberg targets a wide range of opportunities to drive stakeholder alignment. Common characteristics include:

Complex transaction dynamics, including corporate carve-outs and recapitalizations

Family-owned companies looking for a financial, strategic, and/or operating partner to help fuel transformational growth

Special situations where speed and certainty to close are critical

Significant strategic strength, including meaningful market share in a niche sector with pricing power

Financial or operational underperformance with significant value creation upside

Cyclically out-of-favor industry

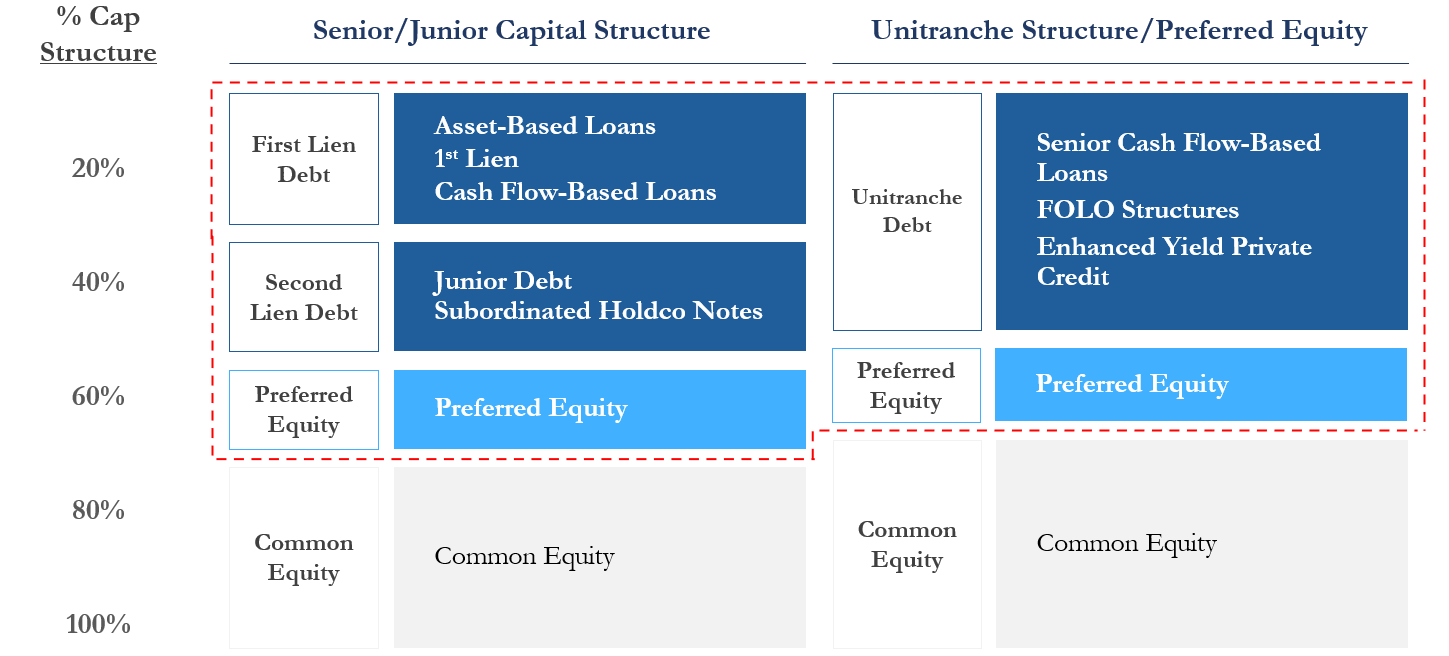

Asymmetric capital structure opportunities

Deep operational expertise through operating executive network